modified business tax id nevada

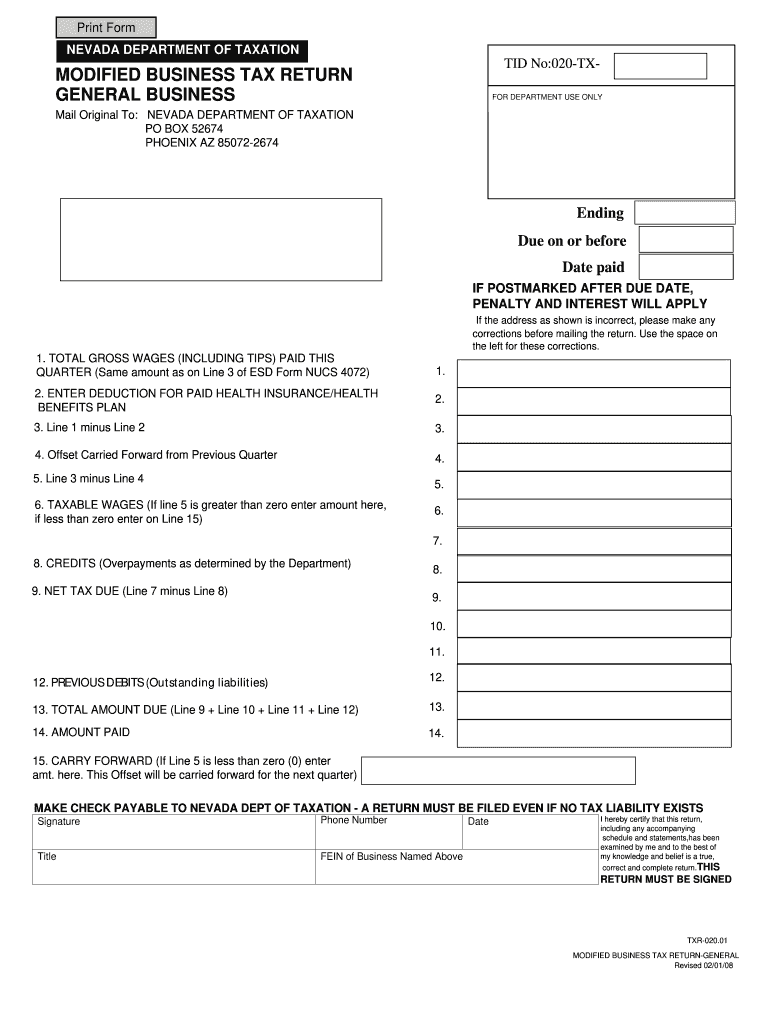

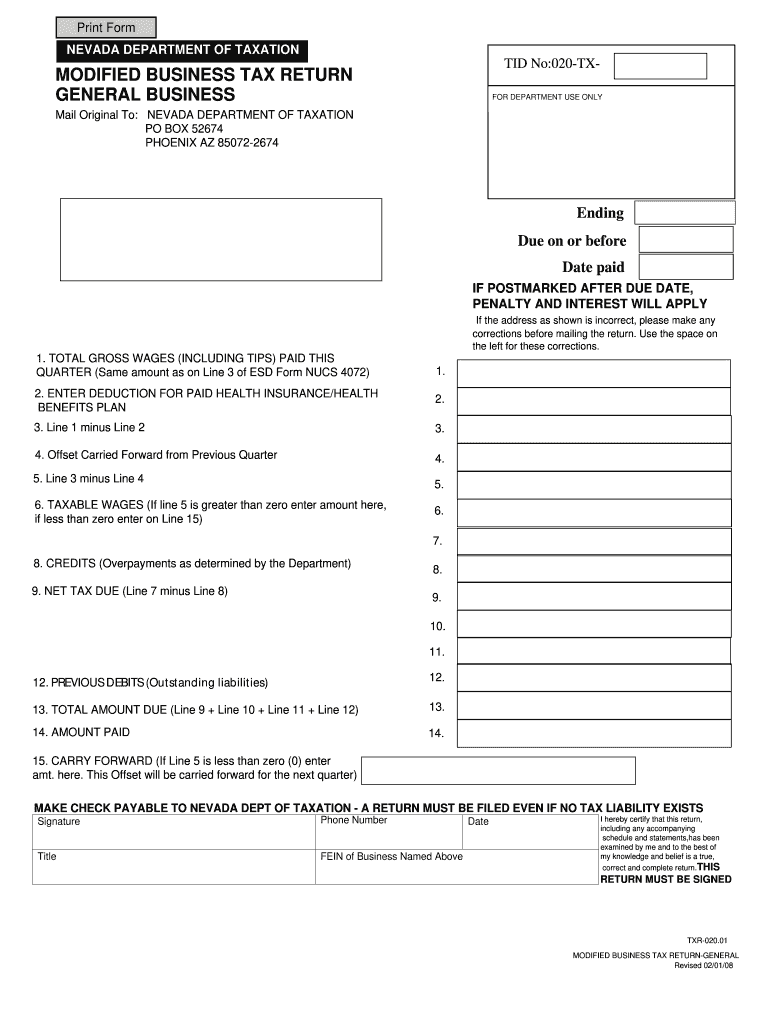

This is the standard quarterly return for reporting the Modified Business Tax for General Businesses. These numbers are required for us to make state tax.

Nevada Business Registration 2004 Form Fill Out Sign Online Dochub

Searching the TID will list the specific taxpayer being researched with its affiliated locations.

. The modified business tax covers total gross wages less employee health care benefits paid by the employer. What is the Modified Business Tax. Sign Online button or tick the preview image of the blank.

The modified business tax covers total gross wages less employee health care benefits paid by the employer. Modified Business Tax has two classifications. The Tax IDentification number TID is the permit number issued by the Department.

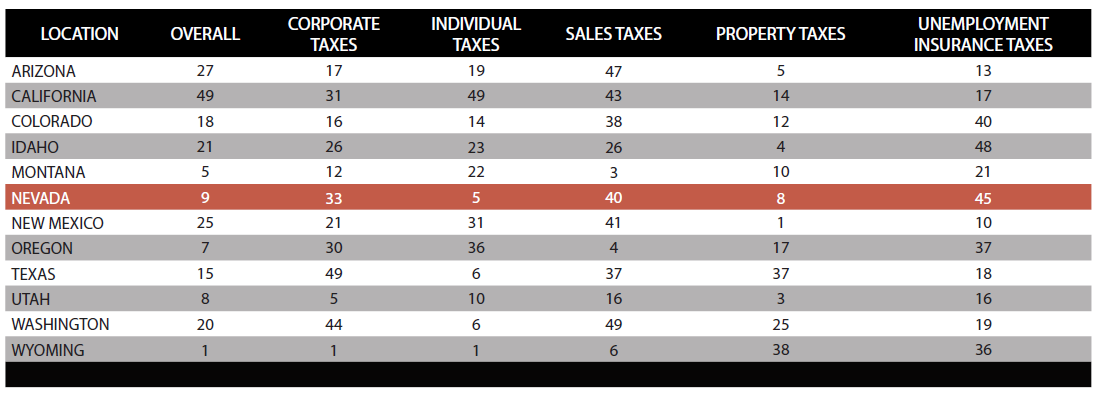

In Nevada there is no state-level corporate income tax. SB 483 of the 2015 Legislative Session became effective July 1 2015 and. Employers who pay employees in Nevada must registerwith the NV Department of Employment Training and Rehabilitation DETR for an Employer Account Number and.

The easiest way to manage your business tax filings with the Nevada Department of Taxation. However you may owe a modified business tax MBT rate of 117 percent if taxable wages exceed 62500 in a quarter. Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying.

Total gross wages are the. What is the Modified Business Tax. The Nevada Modified Business Tax MBT is a tax on businesses with gross revenues of more than 4 million per year.

A partial abatement of the business tax during the initial period of operation is available. The Tax IDentification number TID is the permit number issued. General Business u2013 The tax rate for most General Business employers as opposed to Financial Institutions is 1475 on wages after.

You must provide a valid Nevada Account Number and Modified Business Tax MBT Account Number to sign up for Square Payroll. Total gross wages are the. To get started on the blank use the Fill camp.

Log In or Sign Up to get started with managing your business and. The modified business tax covers total gross wages less employee health care benefits paid by the employer. The MBT is imposed at a rate of 011 percent of a.

Search by Business Name. How you can complete the Nevada modified business tax return form on the web.

2022 State Income Tax Rankings Tax Foundation

Nevada Modified Business Tax Return Fill Online Printable Fillable Blank Pdffiller

Nevada Commerce Tax What You Need To Know Sage International Inc

City Of Lovelock Business License Application Packet Pdf Free Download

Nevada Taxes Incentives Nv Energy

.jpg?n=7990)

Https Www Nevadatreasurer Gov Home Home

Start A Business In Nevada Today Zenbusiness Inc

Marginal Tax Rates For Pass Through Businesses Vary By State

![]()

2021 Legislative Bill Tracker Nevada Policy Research Institute

Nevada Llc How To Start An Llc In Nevada

How To Form An Llc In Nevada For 49 Nv Llc Formation Zenbusiness Inc

Nevada Modified Business Tax 2008 Form Fill Out Sign Online Dochub

Barrick Gold Corporation Operations Nevada Gold Mines Economic Development

Sisolak Under Fire For Job Killing Taxes In New Ad By Gop Governors Linked Group The Nevada Independent

Nevada Governor Signs New Commerce Tax Into Law Deloitte Us

Nevada Modified Business Tax 2008 Form Fill Out Sign Online Dochub

Nevada Modified Business Tax 2008 Form Fill Out Sign Online Dochub