after tax income calculator iowa

This marginal tax rate means that your immediate additional income will be taxed at this rate. You can use this tax calculator to.

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Unlike the Federal Income Tax Puerto Ricos state income tax does not provide couples filing jointly with expanded income tax brackets.

. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Your average tax rate is 212 and your marginal tax rate is 396. Like the Federal Income Tax New Yorks income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

This is equal to a percentage of Iowa taxes paid with rates ranging from 0 to 20. A tax lien is a legal claim that a local or municipal government places on an individuals property when the owner has failed to pay a property tax debt. Californias 2022 income tax ranges from 1 to 133.

The table below shows average effective property tax rates as well as median property tax payments and home values for every county in Arkansas. Your average tax rate is 165 and your marginal tax rate is 297. After tax pay.

New York collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Like the Federal Income Tax Kansas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. How many income tax brackets are there in Puerto Rico.

While income tax is the largest of the costs many others listed above are taken into. Puerto Rico collects a state income tax at a maximum marginal tax rate of spread across tax brackets. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

How Income Taxes Are Calculated. The United States economy is the largest and one of the most open economies in the world representing approximately 22 of the gross world product. After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax.

Your household income location filing status and number of personal exemptions. How to calculate Federal Tax based on your Monthly Income. Your average tax rate is 1198 and your marginal tax rate is 22.

Federal tax State tax medicare as well as social security tax allowances are all taken into account and are kept up to date with 202223 rates. This marginal tax rate means that your immediate additional income will be taxed at this rate. How Income Taxes Are Calculated.

For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035. This marginal tax rate means that. The Federal Tax Calculator below is updated for the 202223 tax year and is designed for online calculations including income tax with Personal allowance refundable non-refundable tax credits Federal Tax State Tax Medicare Social Security and Yearly Income Tax deductions we also have State Tax calculators available for each state.

This page has the latest California brackets and tax rates plus a California income tax calculator. Were proud to provide one of the most comprehensive free online tax calculators to our users. How to Calculate Salary After Tax in Florida in 2022.

The individual income tax rate in Puerto Rico is progressive and ranges from 0 to 33 depending on your income. Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

If you make 70000 a year living in the region of New York USA you will be taxed 12312. Oregons maximum marginal income tax rate is the 1st highest in the United States ranking directly. The state income tax ranges between 3 and 65 but the median real estate tax bill is one of the lowest in the country at just 653.

Notably Puerto Rico has the highest maximum marginal tax bracket in the United States. Detailed Mississippi state income tax rates and brackets are available on this page. Another way of looking at property taxes is the average effective rate.

Check your eligibility for a variety of tax credits. Enter your details to estimate your salary after tax. Enter household income you received such as wages unemployment interest and dividends.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Property Tax Rates in Arkansas. Oregon collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Income tax tables and other tax information is sourced from the California Franchise Tax Board. Estimate your federal and state income taxes. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Kansas collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Like the Federal Income Tax Oregons income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. After a municipality issues a tax lien.

The income tax system in Puerto Rico has 5 different tax brackets. Qualified children for the EITC must be dependants under age 19 full-time dependant students under age 24 or fully disabled children of any age. Use our income tax calculator to find out what your take home pay will be in Washington for the tax year.

Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary. You can learn more about how the Puerto Rico. This places US on the 4th place out of 72 countries in the International Labour Organisation statistics for 2012.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Your household income location filing status and number of personal exemptions. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

Choose the filing status you use when you file your tax return Input the. Choose your filing. The Earned Income Tax Credit or EITC is a refundable tax credit for lower to middle income working families that is largely based on the number of qualifying children in your household.

The following steps allow you to calculate your salary after tax in Florida after deducting Medicare Social Security Federal Income Tax and Florida State Income tax. So for example if your Iowa tax liability is 1000 and your school district surtax is 15 you would pay an additional 150. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Calculate your expected refund or amount of owed tax. New Yorks maximum marginal income tax rate is the 1st highest in the United States ranking directly. This income tax calculator can help estimate your average income tax rate and your take home pay.

This refers to the average annual property tax payment divided by the average property value. Kansas maximum marginal income tax rate is the 1st highest in the United States ranking directly. For instance an increase of 100 in your salary will be taxed 3955 hence your net pay will only increase by 6045.

5 Smart Ways To Use Your Tax Return Millennial In Debt Money Management Advice Saving Money Quotes Money Saving Strategies

Income Tax Calculator Estimate Your Refund In Seconds For Free

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

How Is Tax Liability Calculated Common Tax Questions Answered

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Iowa Paycheck Calculator Smartasset

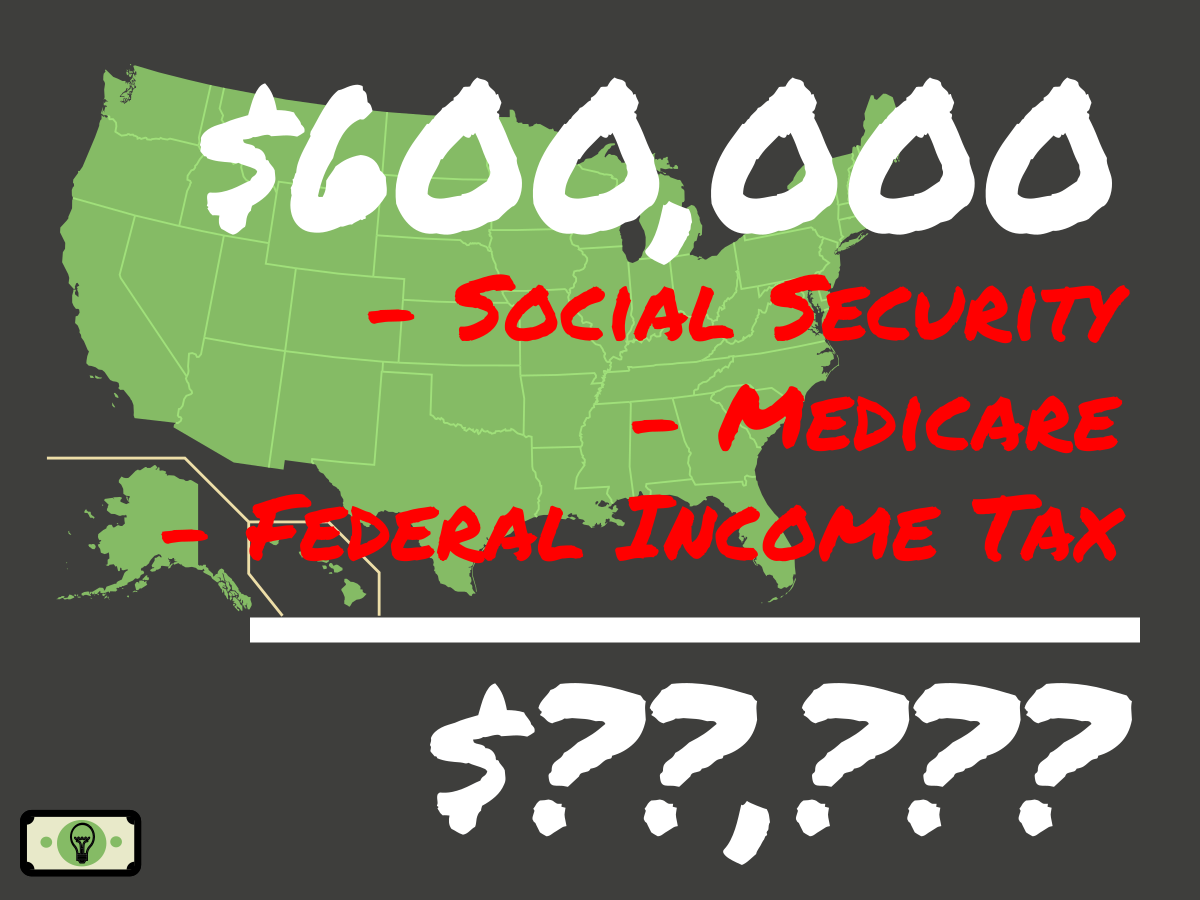

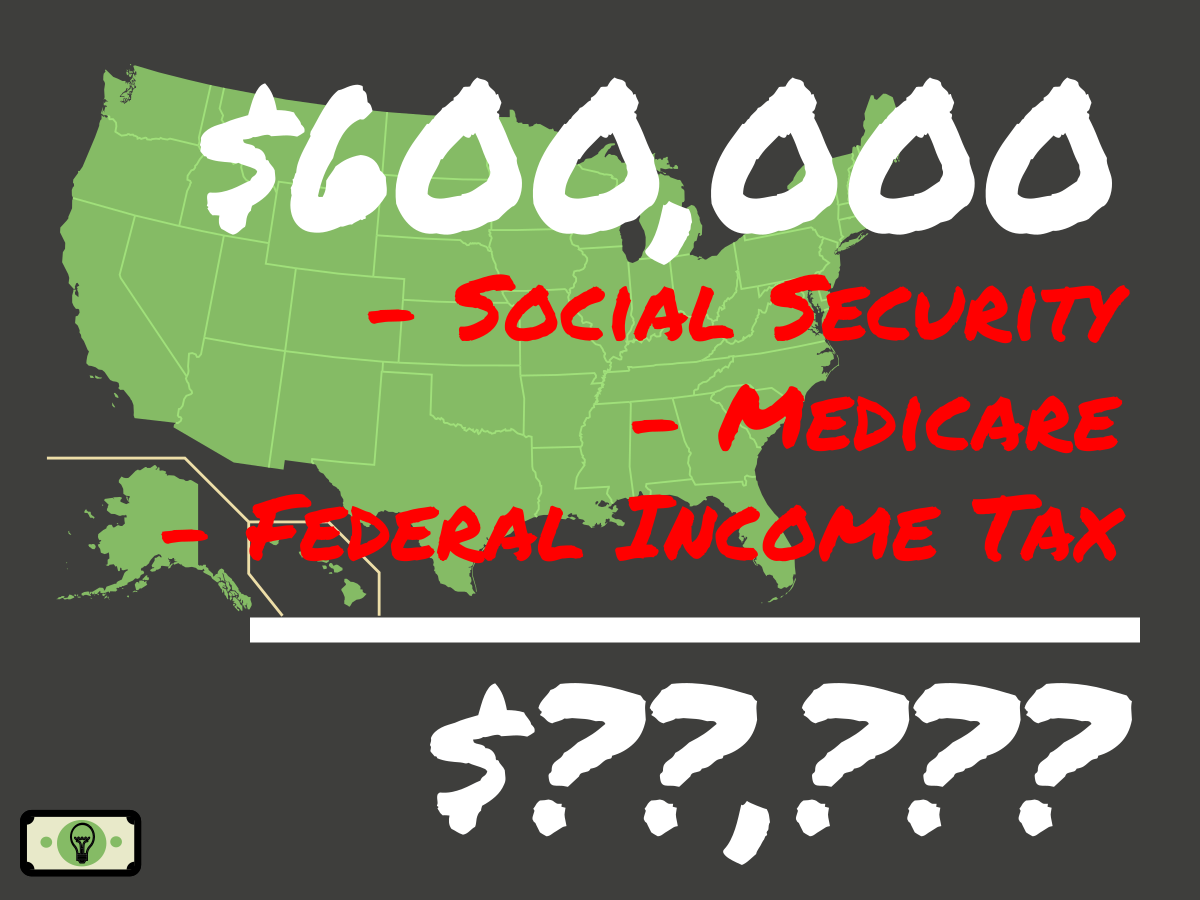

How Much Is 600 000 A Year After Taxes Filing Single Smart Personal Finance

![]()

Iowa Paycheck Calculator 2022 With Income Tax Brackets Investomatica

In Iowa Your Taxes Help Corporations Not Pay Theirs Caffeinated Thoughts Tax Help Tax Forms Business Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

2022 Federal State Payroll Tax Rates For Employers

Income Tax Calculator 2021 2022 Estimate Return Refund

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

You May Not Want To Hear How Much Money You Have To Make To Live In Northern California Map Usa Map 30 Year Mortgage

How Do State And Local Individual Income Taxes Work Tax Policy Center